Let's get "Blue Declaration Special Deduction 650,000 yen" at E-Tax this year

The final tax return for three years (2021) has arrived.The declaration period is from February 16, 2022 (Wednesday) to March 15 (Tuesday).It is unlikely to be uniform extension ( * If it is difficult to declare due to the new colon virus infection, until April 15, the procedure is simplified and applied for extension of the tax return and payment deadline individually.You can do it).

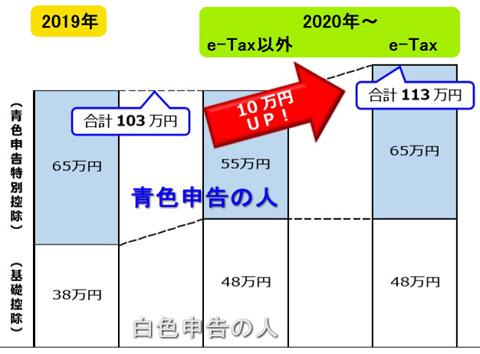

The tax system was amended since 2020 (2nd year), and most people with income have revised the "basic deduction" from 380,000 yen to 480,000 yen.Along with this, the "Blue Declaration Special Deduction" of a sole proprietor has also been revised.

Until 2019, whether you mail your final tax return, bring it to the tax office, or to declare electronic filing with e-Tax, the special blue tax return deduction was 650,000 yen.From 2020, the submission method other than E-TAX was 550,000 yen, and if it was submitted in E-Tax, the deduction amount was different.According to the NTA materials, 1.35 million (1.7 times) increased by E-TAX from home last year for 2020 tax returns.It seems that the number of e-tax declarations has increased due to the difference in deductions by E-Tax and the influence of the new colon virus, which has chosen to declare from home.

Even those who have been doing "e-Tax through" have come up with a heavy waist and switched to E-Tax tax returns.In this article, we will explain the procedure from bookkeeping to completing the tax return for three years (2021) for a sole proprietor (2021).

[table of contents]

- e-Taxで確定申告すると「控除額10万円アップ」

- e-Taxで確定申告すると「毎年2万5000円~4万円お得」

- e-Taxの方法は「マイナンバーカード方式」と「ID・パスワード方式」

- 確定申告の「9つのステップ」

- 無料で始められる「青色申告ソフト」を使ってみよう- 初期設定のポイント【概要】【実践】- 勘定科目設定のポイント【概要】【実践】

- 記帳の手間を大幅削減、「アグリゲーション機能」で取引履歴を取り込もう- 銀行の個人口座の取引履歴を自動で取り込む【概要】【実践】- 銀行の法人口座の取引履歴を自動で取り込む【概要】【実践】- クレジットカードの履歴を取り込む【概要】【実践】- モバイルSuica・スマホ決済などの取引履歴を取り込む【概要】【実践】- 家計簿アプリなどの外部サービスと連携する【概要】【実践】- 事業専用口座以外は個人口座とする【概要】【実践】- 「スマート取引取込」から「やよいの青色申告 オンライン」に経費を記帳する【概要】【実践】- 「スマート取引取込」から「やよいの青色申告 オンライン」に入金を記帳する【概要】【実践】

![10th generation Core i5 equipped 9.5h drive mobile notebook is on sale at 50,000 yen level [Cool by Evo Book] 10th generation Core i5 equipped 9.5h drive mobile notebook is on sale at 50,000 yen level [Cool by Evo Book]](https://website-google-hk.oss-cn-hongkong.aliyuncs.com/drawing/article_results_9/2022/3/9/4a18d0792cae58836b71b9f591325261_0.jpeg)

![[Amazon time sale in progress! ] 64GB microSD card of 1,266 yen and wireless earphone with noise canceling function of 52% off, etc. [Amazon time sale in progress! ] 64GB microSD card of 1,266 yen and wireless earphone with noise canceling function of 52% off, etc.](https://website-google-hk.oss-cn-hongkong.aliyuncs.com/drawing/article_results_9/2022/3/9/c88341f90bab7fe3ce1dc78d8bd6b02d_0.jpeg)